Suncorp Group is turning to machine learning in a bid to make eye-glazing product disclosure statements simpler and decipherable to insurance buyers.

The company is using two IBM Watson services - Discovery and Conversation - to power what it is calling the “PDS Smart Search” tool.

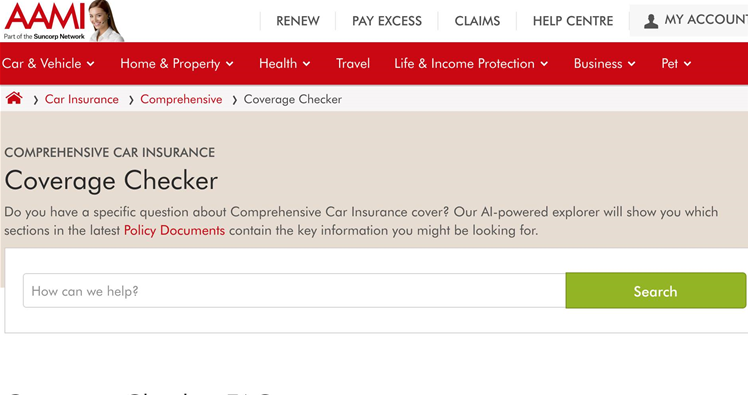

PDS Smart Search is now live on Suncorp-owned AAMI’s website where it can be used to ask natural language questions of the company’s comprehensive car insurance policy product disclosure statement (PDS).

“The Explorer uses machine learning that’s been trained to understand natural language,” the company said in published FAQs.

“Every time you ask a question, it searches its entire history of queries to return what should be the most relevant sections based on previous customer feedback.”

The existence of PDS Smart Search was first revealed at the recent IBM Think conference in Sydney.

David Billington, a senior digital interaction and automation lead at Suncorp Group, said the idea for a natural language-searchable PDS had come about after the Group “came across” research on how few insurance buyers actually read the statements.

A PDS is usually a fat printed booklet of legalese supplied with insurance policies that details what is and isn’t covered.

“They typically run from 40 to 80 to 180 pages, so they’re really long and quite complex, and they detail the nitty gritty [of the policy],” Billington said.

“We came across some research where we learned that actually only 20 percent of people actually read the PDS.

“Even more worrying though is that when you dug a bit deeper into the 20 percent, it turns out that the idea of “read it” is they read a paragraph or looked up a certain section.”

Billington said the project focused on taking a long and complex PDS document and “breaking it down into something that’s snackable, bite-sized and simple.”

The result is PDS Smart Search, which allows customers “to query the PDS in their own language.”

“Typically if you wanted to look up a certain section you had to know the type of terminology we used or the industry jargon,” Billington said.

“This removes the barrier to entry for what is typically a long and scary document.

“This had a great outcome because [customers are] now more aware of what their level of cover is and we’re going to have a better outcome down the line at claims time.”

After each question, the tool asks users for feedback, some of which ends up helping to train the underlying machine learning model.

The feedback is surfaced in a specific portal where the business is able to view it and “only accept feedback that they considered valuable to go into the model”, Billington said.

The company’s frontline contact centre staff had a hand in selecting feedback, given they were closest to how customers experienced the insurance products.

Suncorp already uses IBM Watson in other parts of its insurance business.

In 2017, it put a Watson-powered accident liability determination system into production for its AAMI, GIO, APIA, Bingle and Suncorp insurance brands. The project won an iTnews Benchmark Award the following year.

Ry Crozier attended IBM THINK 2019 in Sydney as a guest of IBM Australia.

.jpg&h=140&w=231&c=1&s=0)