Westpac will seek more information on-the-spot from customers deemed at risk of paying scammers, with a new AI-powered capability to be inserted into its banking app.

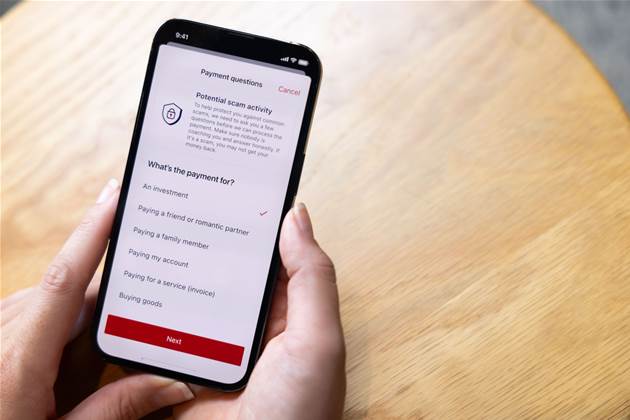

The capability, called SaferPay, will insert “a series of questions” into the payment flow.

“If customer responses suggest the payment is highly likely to be a scam, Westpac will not allow the payment to be processed,” the bank said.

It will initially be launched in the Westpac app before being expanded to online banking “in the coming months”.

“Westpac SaferPay presents customers with a series of questions in instances where we detect a payment has high scam potential,” CEO Peter King said.

“The presented questions will vary for each customer, tailored based on the information the customer provides.”

NAB launched a similar prompting capability last year that it said had already saved customers tens of millions of dollars.

CBA and Telstra are also working together on ways to detect in-progress scams.

Westpac said that it had saved some $400 million of customers’ money from being transferred to scammers in the past two years from existing anti-scam work.

But it said there was still more that could be done, and that included at Westpac and more broadly across the Australian business sector.

“To truly make Australia a hard target for scammers, we now need to apply the same protection across the entire scam ecosystem,” King said.

“So long as scammers can freely operate across mobile phones, web browsers and social media platforms, Australians remain vulnerable to scams.

“We welcome the work underway by the federal government on a mandatory industry code that considers a whole-of-ecosystem approach to effectively tackle this problem.”

.jpg&h=140&w=231&c=1&s=0)

.jpg&h=140&w=231&c=1&s=0)

.jpg&h=140&w=231&c=1&s=0)